Indicators on Life Insurance Company You Need To Know

Wiki Article

Life Insurance Louisville Ky Fundamentals Explained

Table of ContentsNot known Details About Life Insurance Companies Near Me Life Insurance Quote Online for DummiesAll About Life Insurance CompanyThings about Life Insurance CompanyThe Greatest Guide To Life Insurance OnlineSome Known Questions About Term Life Insurance Louisville.

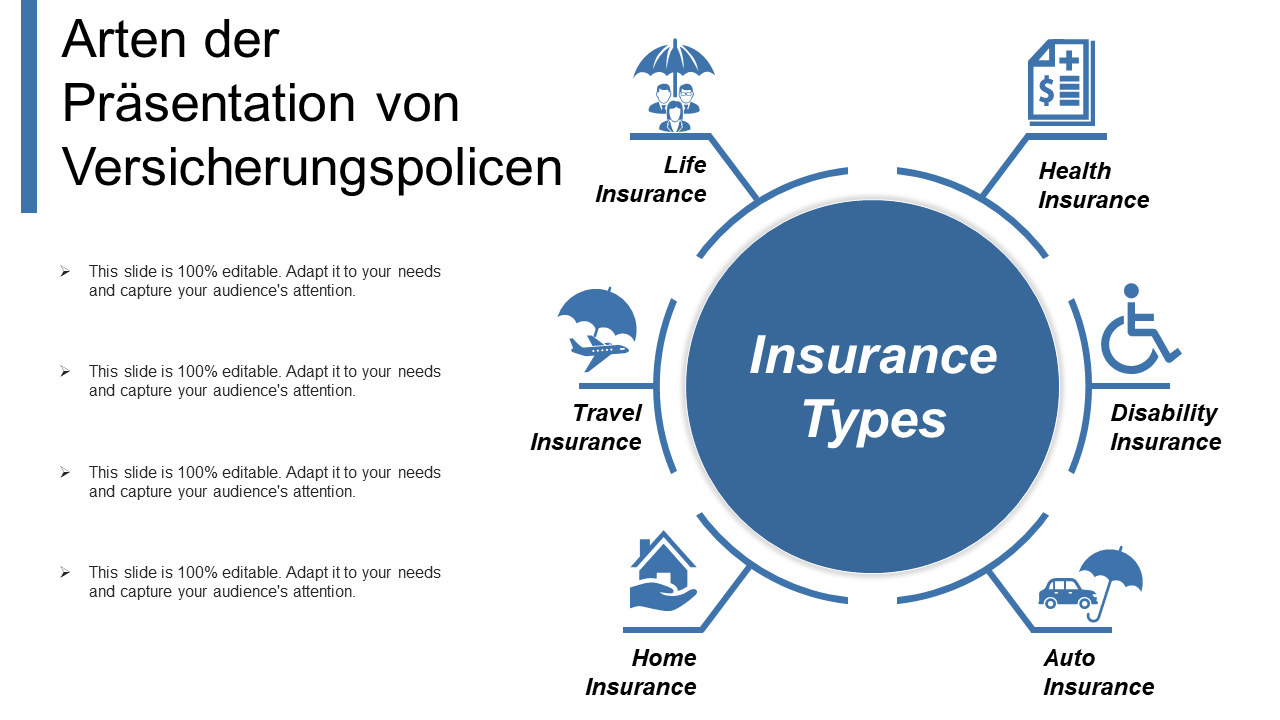

If you drive without car insurance and also have an accident, penalties will most likely be the least of your economic problem. If you, a passenger, or the various other vehicle driver is hurt in the crash, vehicle insurance policy will certainly cover the expenses and also help guard you against any type of litigation that might result from the crash (Whole life insurance).Again, just like all insurance, your individual circumstances will determine the cost of vehicle insurance policy. To make certain you obtain the right insurance policy for you, contrast several rate quotes and also the protection offered, as well as examine regularly to see if you get approved for lower rates based upon your age, driving record, or the location where you live.

If your company does not provide the type of insurance you want, acquire quotes from several insurance service providers. While insurance policy is pricey, not having it could be far more expensive.

Fascination About Whole Life Insurance

Insurance resembles a life vest. It's a little a nuisance when you do not require it, however when you do need it, you're greater than grateful to have it. Without it, you could be one car wreckage, ailment or residence fire far from drowningnot in the ocean, but in the red (Cancer life Insurance).

The Ultimate Guide To Life Insurance

This level of insurance policy covers your losses that aren't created by a wreckage such as theft, criminal damage, flood, fire and also hail. Once more, an insurance coverage representative is a great resource to assist you determine the degree of security you require based on the type of auto you drive (Whole life insurance).

One more note concerning homeowners insurance coverage: Inspect with your representative regarding what your plan covers and also what it does not. Many property owners don't know that flooding insurance is left out from their policies.

The 7-Minute Rule for Term Life Insurance Louisville

If you're an occupant, you're not off the hook for insurance coverage. Without tenants insurance policy, it depends on you to replace your possessions if they are shed in a fire, flooding, break-in or some other calamity. An excellent ndependent insurance policy agent can stroll you through the steps of covering the basics of both house owners and tenants insurance coverage. Life insurance online.3. Umbrella Plan An umbrella policy is a type of insurance policy that adds an additional layer of security for you and your properties when you require coverage that surpasses the limits of your home owners or automobile insurance coverage. For example, if you're at fault for a multiple-vehicle crash, clinical expenses and home damages might quickly amount to more than your automobile insurance will cover.

For a couple of hundred bucks a year, an umbrella policy can enhance your obligation insurance coverage from the common $500,000 to $1. Talk with an Endorsed Local Provider to determine the type of insurance policy coverage that's right for you and your household.

Life Insurance Can Be Fun For Anyone

Wellness Insurance policy Medical financial debt contributes to almost half of all insolvencies in America according to the Kaiser Family Structure. One unanticipated major medical emergency situation could amount to hundreds of thousands of bucks of expenses.With a high-deductible plan, you're responsible for more of your up-front health care costs, however you'll pay a reduced month-to-month premium. A high-deductible health strategy qualifies you to open up an HSAa tax-advantaged cost savings account especially for paying clinical expenditures.

Various Discover More other HSA advantages consist of: Tax obligation reduction. You can subtract HSA contributions from your gross pay or business earnings. In 2017, the tax deduction is $3,400 for singles as well as $6,750 for married pairs. Tax-free development. You can spend the funds you contribute to your HSA, and they grow tax-free to use currently or in the future.

How Whole Life Insurance can Save You Time, Stress, and Money.

You can use the cash tax-free on professional clinical expenses like medical insurance deductibles, vision and also oral expenditures. Some companies currently provide high-deductible health insurance with HSA accounts in addition to standard medical insurance plans. Compare your alternatives and see if a high-deductible strategy could wind up conserving you cash.Long-Term Special needs Insurance Lasting special needs insurance protects you from loss of revenue if you are unable to work for an extended period of time due to a health problem or injury. Do not believe a long-term disability could sideline you and also your capacity to work? According to the Social Security Management, simply over one in four of today's 20-year-olds will end up being handicapped before reaching age 67.

Report this wiki page